Humber Freeport

Tax Sites

There are several advantages for being inside a new tax site. These sites are specifically there to attract new businesses and stimulate new investment into the area. Benefits include accelerated capital allowances, relief from stamp duty and land taxes; relief from business rates and finally relief from employer’s National Insurance contributions for the first three years of being operational.

• Green Energy Jobs

• Decarbonisation

• Exports

• Rail industry supply chain

• Innovation centre

• Green Energy jobs

• Expansion of South Humber Industrial Investment Park

In the Humber Freeport there are

three new tax sites proposed:

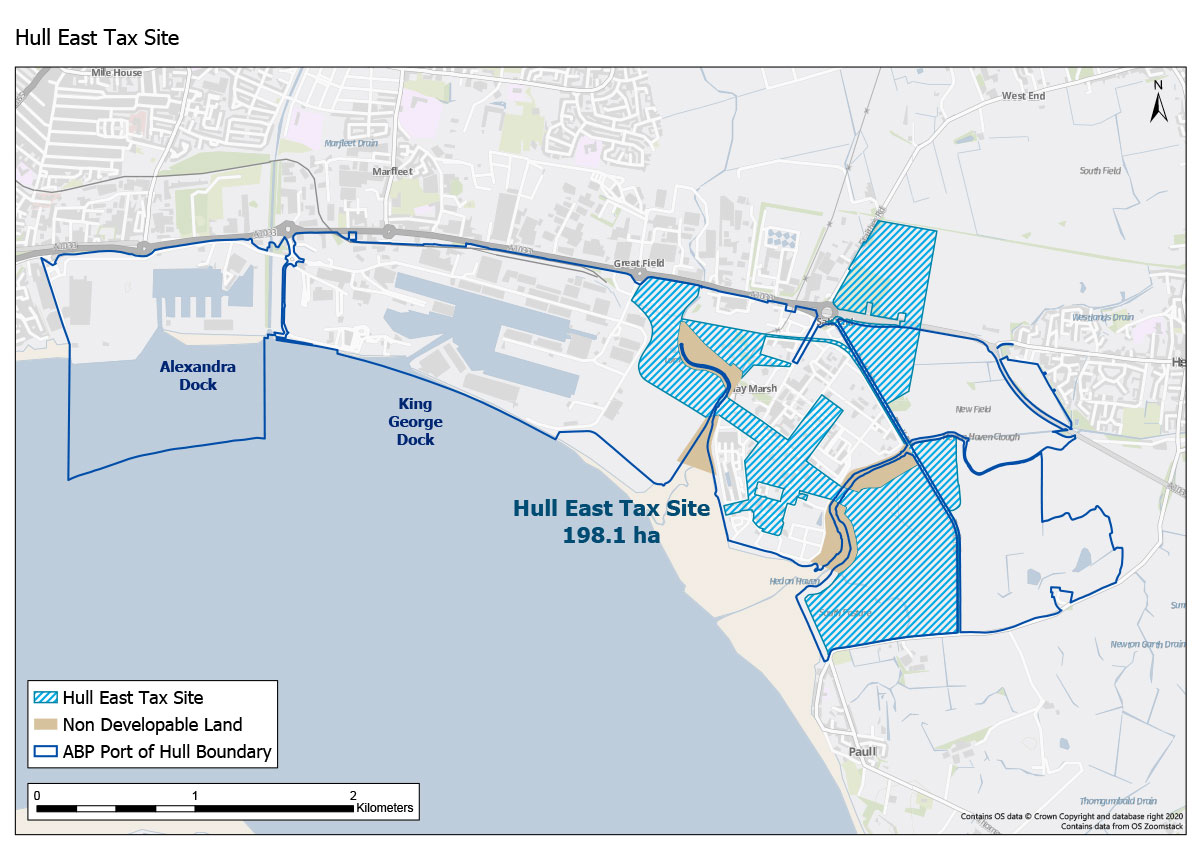

Hull East

This site takes in several different parcels of land. They are ABP’s Humber International Enterprise Park, the Yorkshire Energy Park, Saltend Chemical Park and eastern portion of the Port of Hull. A new hydrogen plant is proposed within this site as well as the opportunity to decarbonise Saltend Chemical Plant and create exportable surplus of hydrogen and decarbonised chemical products. The Yorkshire Energy Park offers immediate developable opportunities including incubation spaces and also the Saltend proposed site for Pensana plc, a rare earth processing plant which forms part of the magnet / battery supply chain for offshore wind and electric vehicles.

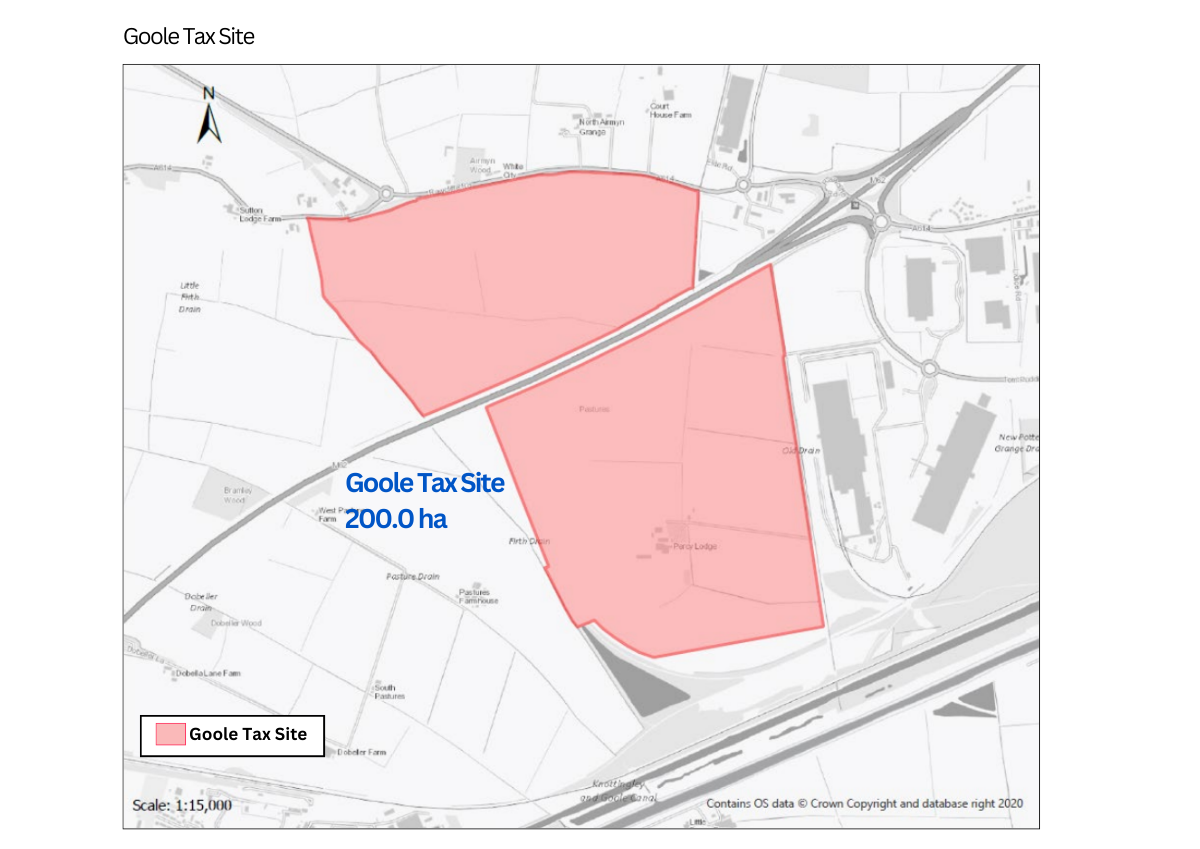

Goole

A unique opportunity to co-locate supply chain for the new Siemens rail factory (under construction). The site takes in a large undeveloped site with excellent transport links. The site is ideally situated to address deprivation in Hull, Goole, Scunthorpe as well as East Yorkshire (Doncaster, Wakefield)

How do existing local

businesses benefit?

We will know more about this as details emerge. However, it is the intention to incentive new investors to the area to use local suppliers, to boost existing businesses across the Humber. Businesses will also benefit from the general uplift in economic activity in the area catalysed by the freeport.

How can my land be added

as a tax site or customs zone?

It is our ambition that if Humber Freeport is successful it will grow over time. However, it will take Government approval to add new sites into approved zones. We hope new Government guidance on this will be made available in the future to help guide how zones can be expanded.